Self-checkout (SCO) has become a mainstay of modern retail operations.

Introduced 30+ years ago, this shopper-operated technology has reached record adoption and is forecast to continue to grow. The original business case was always driven by increasing customer throughput and reducing/redeploying labour, but now the conversation is evolving to also consider whether retailers are losing some of these gains through customer mistakes, theft and fraud.

With AI on the uptick and labour shortages, shrink, in-store safety and margin improvement on everyone’s agenda, SCOs are splitting opinion once more.

Lisa Bowden, Flooid’s Senior Product Marketing Manager, talks about what lies ahead for SCO.

Lisa, where are we with SCO today?

Retail loss prevention is no longer a siloed function—it’s a strategic imperative that intersects with customer experience, operational efficiency, and staff wellbeing. There should be a nuanced understanding of how retailers can leverage technology, data, and human behaviour to mitigate loss across diverse store environments.

We’re in a state of evolution. Retailers are committed to the SCO model, but also aware there are two big unresolved issues; shopper frustration and loss prevention. In response, retailers are seeking to improve the customer experience, while shutting down opportunities for theft and accounting for customers simply making innocent scanning mistakes which drain profits.

Source: Datos Insights

In all cases, this involves thinking very carefully about how software, hardware, staff duties, and protocols for technology and in-person interactions work together — including at peak times and slower trading periods.

How big is the loss prevention issue?

Big. As an example, in 2024 Co-op in the UK lost £80 million from theft, up 14% YOY. The National Retail Federation estimates shoplifting incidents and dollar losses from thefts nearly doubled last year. Theft is growing in frequency, scale and seriousness; retailer spending on crime prevention rises by roughly 20% each year, organised crime is on the uptick, and the cost-of-living crisis is allegedly even driving some law-abiding citizens into criminality.

These losses are clearly unsustainable, and we’ve seen wave after wave of news headlines about self-checkout (SCO) theft; however, the important thing to know is growth in SCO is not slowing down. In fact, in the UK 96% of grocery stores offer SCO already, and projections indicate that by 2030, over 24,000 stores will offer SCO.

And it’s not just in the traditional grocery environments, we’re seeing growth in SCO deployment in fashion, specialty, convenience, fuel, hospitality and even travel stores. While in store shrink is not entirely due to issues at the front end, in particular SCO, it’s an area that retailers are hyper-focused on addressing as they understand the need to increase the density and variety of SCO options to support consumer demand for speed and ease of checkout.

How can the problem of loss be countered?

Effective loss prevention is not one-size-fits-all. It requires a layered approach based on the trading environment, customer demographics, staff profiles and budget constraints.

Lisa categorises solutions into four key areas:

- UI Enhancements: Clear transaction visibility and accurate product imagery

- Remote Assistance: Companion apps for real-time visibility, support and intervention

- Data & Transaction Analytics: Detailed data analytics to advanced AI to predict probabilities and patterns with computer vision to detect physical high-risk behaviour

- Third-Party Technologies: CCTV, body cameras, RFID, and facial recognition

Each layer contributes to a holistic defence strategy, with flexibility to adapt to store-specific needs.

Are store assistants under pressure?

Absolutely, there is increased and targeted staff vigilance expected, but that’s where new technology can help. To caveat, we shouldn’t underestimate the power of tone, body language, and empathy that store associates can deliver when properly trained.

It’s difficult to steal from someone who has established eye contact and friendly communication with you.

Remote intervention tools, such as the Flooid Empower solution, enhance surveillance as well as customer experience. By enabling staff to assist customers without being physically adjacent, Empower reduces friction, deters theft, and improves satisfaction—turning loss prevention into a proactive, customer-friendly interaction.

How will emerging technologies help?

Firstly, it’s important to understand the experience you want your customers to have and then balance that with appropriate loss solutions that fit those objectives. Balance is key because you don’t want to alienate your customer base with draconian measures.

For speed: RFID, long underutilised, is gaining traction—especially in fashion and now expanding to liquids and bottles, providing a ‘passport’ for products and quick checkout.

For in the moment analysis: computer vision, while promising, is still maturing in self-checkout applications. It’s important to point out that some retailers struggle to realise ROI where the focus is on isolated initiatives, preventing them from leveraging the full spectrum of available data.

For intelligent insights: AI and machine learning offer real potential, although their effectiveness hinges on the quality and breadth of data captured. Done right, you can obtain actionable insights immediately. We’re focusing in this area as Flooid leverage our unified commerce platform to centralise and analyse data, enabling smarter interventions and predictive insights.

What impact are shoppers seeing?

There have been plenty of changes in stores and processes. Some stores have asked customers to scan receipts or go through a swing gate after the transaction. Others have given body cameras to staff.

There is a growing awareness that SCO ‘guardians’ can have varying roles, from dedicated SCO attendant to ‘fractional’ SCO attendant, where they are also fulfilling other duties in store along with confirming age verifications at SCO and addressing interventions. With these different roles, different solutions supporting multitasking are required.

Many retailers are still working to strike the right balance in staff protocols, addressing a wide range of concerns—from managing suspected theft to ensuring employee safety.

Source: Datos Insights

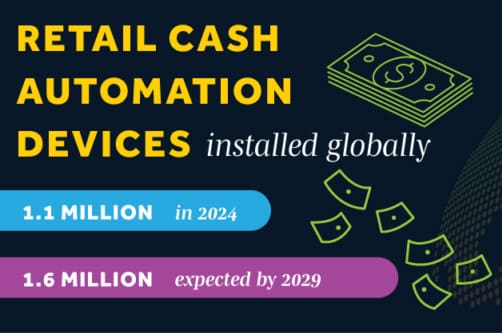

Cash remains a significant loss vector. Closed-loop cash recycling systems, like those from Flooid’s parent company, Glory, automate cash handling, reduce human error, and enhance security. With rising cost-of-living pressures, cash usage is increasing, making secure and efficient cash management more critical than before.

Source: Glory Global Solutions

What can Flooid do to help?

Firstly: advice. We’ve worked with major brands for four decades, giving us deep knowledge and real-world examples to draw on and share with our customers.

Secondly: technology. Our platform is composable and built with open APIs, meaning retailers can trial our own Loss Prevention Rules Engine (LPRE) solution along with enhanced third-party AI, CV and LP solutions that fit their business with ease of integration to their ecosystem.

In summary, loss prevention in retail isn’t just about stopping theft – it’s about creating smarter, more supportive environments for both staff and customers. When you layer the right tech with good data and thoughtful human interaction, you don’t just reduce loss—you improve the whole shopping experience.

Flooid works with the largest retailers in the world. If you want to learn more about the capabilities of Flooid, contact us.

Flooid travaille avec les plus grands détaillants du monde. Si vous souhaitez en savoir plus sur les capacités de Flooid, contactez-nous.

18th February 2026

Make the most of EuroShop

Flooid Blog,Flooid Blog

18th February 2026

Move fast and stay flexible with Flooid

Flooid Blog,Flooid Blog

13th February 2026

Waitrose renews their relationship with Flooid

Flooid Blog,Flooid Blog

13th February 2026

Meet Flooid at EuroShop 2026

Flooid Does

26th January 2026

Flooid Thinks: Loss Prevention with Lisa Bowden

Flooid Thinks

9th January 2026

Building retail resilience in Australia

Flooid Blog,Flooid Blog

2nd January 2026

Ones to watch at NRF 2026

Flooid Does

19th December 2025

Meet our partners for NRF 2026

Flooid Does